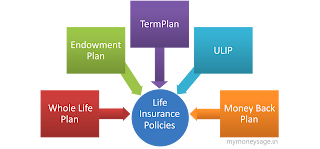

Various Types of Life Insurance Policies

Various Types of Life Insurance Policies Disaster protection is one of the most significant strategies that you should take with the goal that you can desert enough money related security to your family, in the event of your heartbreaking passing. In the event that you are hitched or have wards who admire you monetarily, it is an unquestionable requirement to take life coverage approach. There are three fundamental sorts of protection approaches that you have to know: Term Insurance: Term protection is the most widely recognized and essential extra security arrangement. You get an aggregate guaranteed sum on your passing, which is given out to the individual you designated for in the protection understanding. So here, you need to decide how a lot of the existence spread ought to be, the arrangement residency and so forth. The top-notch cash that you pay for this sort of protection is the most reduced among all disaster protection items. Anyway, you don't get back any cash in